Corporate Travel Landscape - Trends & Challenges

An evaluation of the current business travel landscape and supply environment for air, hotel and rail inventory through the 2012 Global Corporate Travel Benchmarking Study and Travel Manager Research by Egencia, released this month.

Focusing on top domestic and international business destinations in Europe, North America and Asia-Pacific, Egencia analyses industry trends, supplier data and capacity implications in Q1 2012. Additionally, it surveyed over 300 travel buyers globally identifying current trends and challenges.

Travel managers surveyed universally identified cost control/reducing expenses (77 percent) as the greatest challenge facing their travel programs, followed by traveler compliance/policy enforcement (40 percent), Egencia reports.

Average daily rates (ADRs) for hotel stays have also increased in the majority of business destinations, continuing a reversal of previous trends.

Improved occupancy and a decreasing amount of new hotel supply coming into the market has led to slightly higher room prices (approximately 6 percent in North America, 3.3 percent in Europe, and 5.7 percent in the Asia-Pacific region).

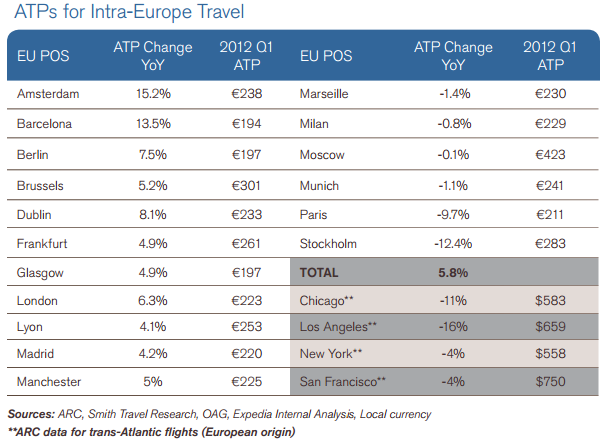

Average ticket prices (ATPs) for air travel have, on average, increased in North America, Asia Pacific and Europe in the last year, attributed to rising jet fuel prices being passed onto travelers and tightly managed capacity discipline by airlines.

Key results of the new benchmarking study:

North America: As a result of increased cost pressures in Q1 2012, ATPs have increased for nearly all routes departing from North America by approximately six percent. These increases can be largely attributed to higher fuel prices, tighter management of capacity, and continued airline consolidation.

Europe: ATPs for European destinations experienced an increase of nearly six percent YoY. Increased ATPs can be attributed to rising fuel prices and tightly managed capacity by airlines. Decreased ATPs can be attributed to overall financial vulnerability of the Eurozone, increased competition from low cost carriers, and increased competition with high speed rail.

APAC: Asia-Pacific represents a mixed air pricing landscape, varying on a market-by-market basis. However, as a whole APAC is averaging an increase in overall ATPs. Prices for Intra-APAC destinations have increased by an average of three percent YoY. Increased ATPs can be attributed to increased fuel costs and increased demand into China. Decreased ATPs can be attributed to increased competition in the local markets and increased capacity on a majority of routes, as more and larger aircrafts enter the Asia Pacific region.

Travel Management Trends: According to respondents of Egencia’s global survey of over 300 travel buyers, 43 percent of buyers expect their travel volumes (number of trips) to increase during the remainder of 2012 (compared with 54 percent in 2011) with 46 percent expecting their overall travel spend to increase. Additionally, 62 percent of travel buyers said they will negotiate more in 2012 (compared to 38% in 2011).

Find the Full Study here.

COMMENTS