FRENZY IN OTAS, STRATEGIC INITIATIVES IN AIRBNB: AN INCREASINGLY COMPLEX ENVIRONMENT REQUIRES SMART STEPS FOR REGULATING SHORT-TERM RENTALS

April 8, 2019

Posted By: Dr Pantazis Pastras

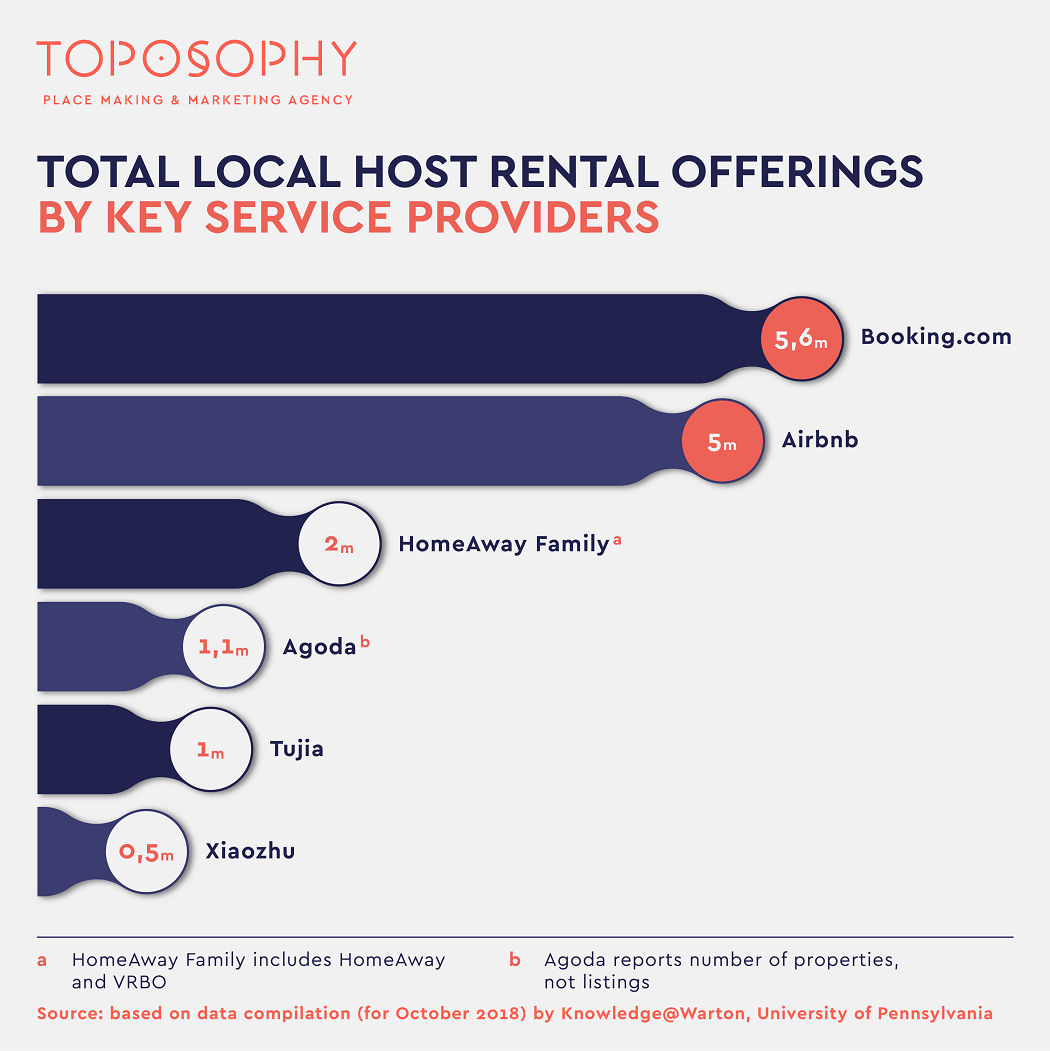

Initially it was all about Airbnb and the exponential growth that the unicorn experienced over the last decade. Gradually a whole new ecosystem was created with more or less established players coming on; Expedia’s penetration into the market of short-term rentals through the purchase of HomeAway in 2015 set the pace for future developments. In October 2018, a key competitor of Expedia, Booking Holdings (with Booking.com) was estimated to have more listings than Homeaway and Airbnb too.

Airbnb was quick to question this unfavourable figure in March 2019, by arguing that it has more listings (6+ million) than Booking.com and should be seen as the unrivalled brand of a community of loyal hosts rather than an aggregator of properties and commodities.

Several aspects define the policy agenda of Airbnb in 2019:

- The recent partnership with Visit Britain is a key step towards enhancing Airbnb’s profile as a contributor to the promotion of local destination experiences and a driver of visitor economy benefits to local communities

- Keeping in pace with key competitors in terms of technological innovation and growth scale is also facilitated by the recent purchase of hotel booking platform HotelTonight.

- The ambition to penetrate into the real estate market by offering even more advanced architectural designs and hospitality services in selected properties that will cater the needs of both residents and visitors

The one million dollar question is obvious here; what do destination authorities need above all? Complex frameworks of regulations which are still costly to monitor? Or smart methods which will prompt both Airbnb and OTAs to play their proper role and facilitate the enforcement of regulations that reflect various priorities (e.g. ensuring the authentic character and well-being of residential neighbourhoods, tackling housing shortage).

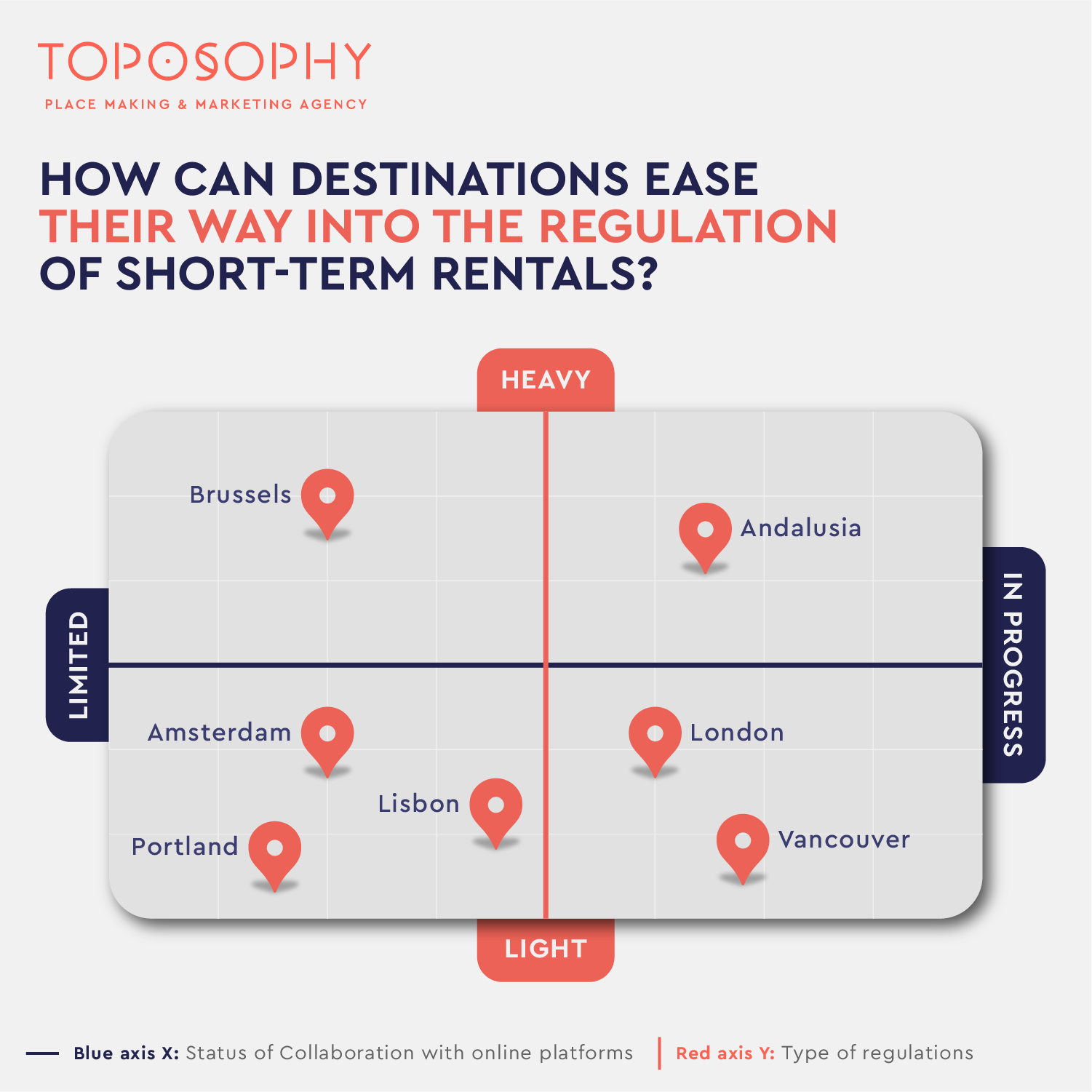

Here it is useful to consider how destination authorities have recently managed to balance between different approaches as summarized in the graph below.

The capital city of Belgium recently discovered that a heavy set of STR regulations is not necessarily the best path to follow. Since 2016, the Region of Brussels-Capital had linked the registration of STR properties with the submission of several documents such as a fire safety certificate and a certificate of compliance with urban planning standards. All STR properties were also required to provide visitors with cleaning equipment, heating installations, safety instructions for the use of facilities, etc. These regulations finally drew however the attention of the European Commission which is firmly against the imposition of disproportionate market access requirements, not taking account of the specificities of the business model concerned or favouring one business model over the other.

The aftermath of Brussels does not suggest that a fairly simple system of STR regulations is a solution per se. Portland in Oregon (US), Lisbon and Amsterdam were among the first destinations to introduce what was seen as sharing economy-friendly regulations a few years ago. Despite tax collection and remittance being carried out by Airbnb in these cities, the respective destination authorities are regularly faced with serious enforcement challenges. Particularly the debate of overtourism in Lisbon and Amsterdam is often driven by issues related to neighbourhood nuisance and soaring property prices. In February 2019 the Amsterdam City Council decided to strengthen its monitoring mechanisms after failing to reach a deal with Airbnb and similar platforms on making sure that they turn off advertisements of listings when the January-introduced 30-day limit is reached.

Light regulations are likely to lead to favourable results for destinations when a specific framework of cooperation is agreed. Since 2017, Airbnb has been fully respectful to the Deregulation Act of 2015 by automatically limiting entire home listings in London to 90 nights a year, unless landlords have obtained a planning permission to use their residential premises as temporary sleeping accommodation. In Vancouver, Canada, new regulations that went into effect in September 2018 contributed within three months to more than 2,000 listings being withdrawn from Airbnb and Expedia’s VRBO. Despite certain challenges, the City Council has a dedicated webpage for reporting progress on law enforcement and is working more closely with both platforms than previously so as to ensure that all listings include the necessary license number.

A trade-off between heavy regulations and tactics that facilitate a notable level of STR activity is also possible to encourage Airbnb and OTAs in exploring fields of cooperation with destination authorities. As of September 2018, both Airbnb and an association made up of other platforms have committed to remove any listings that do not display the registration number provided by the Regional Authority of Andalusia in Spain. The key decision here was linking the official registration process with a simplified online registration system provided by the platforms. Late in 2018 no further discussion was raised on other Brussels-style equipment and facilities’ requirements imposed on local hosts by the Regional Authority. Airbnb also removed 18,000 unregistered properties, yet achieved to maintain a significant volume of more than 40,000 listings throughout the region.

The framework presented here normally has its limitations. It is informed by a limited number of case studies and what is known mainly for Airbnb. The more Booking.com will enhance its market share of urban and vacation rentals the more this analysis will have to assess how market competition creates opportunities and/or challenges for destination authorities. This would be also valuable for clarifying the relationship of the current framework with destinations such as NYC, Barcelona and even Paris, where a series of court cases and prohibitive policies have curtailed partnership-building prospects.

Nevertheless, the framework along with the case studies can guide destination authorities in becoming more effective and ensuring the enforcement of STR regulations. On a basic level, that would involve:

- Identifying the most important issues which inform the relevant agenda in each destination

- Collecting and analysing different sets of data with regard to these issues

- Comparing market access requirements between different forms of accommodation establishments

- Assessing the availability of necessary skills and resources for enforcing different types of regulations

- Selecting those thresholds which are likely to generate a vivid discussion on realistic facts and suggested solutions

- Engaging online platforms and key groups of stakeholders in an open, public dialogue

- Understanding in what areas online platforms would be more likely to negotiate more openly and consider different trade-offs

- 5-year partnership with HOTREC

- Our report on The Collaborative Economy and Scottish Tourism for Scottish Enterprise

- Our report on DMOs and the Sharing Economy for European Cities Marketing

COMMENTS